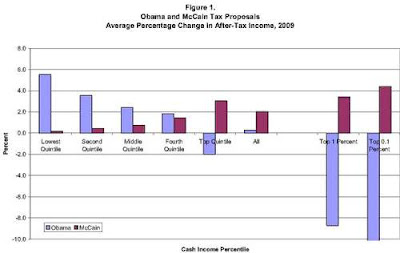

Take a look at the graphics below and notice the differences at the top and bottom income levels.

At first glance, you see that the Obama plan benefits the most Americans. The number of taxpayers who get a tax break is greatest with the Obama plan.

On the other hand, McCain proposes huge tax breaks for the wealthy. This is just more of the same Republican trickle-down economics which led to skyrocketing national deficits and failed to balance the budget in the Reagan and Bush administrations.

McCain (net worth 21-45 million) gives ultra-rich folks the greatest tax breaks while cutting taxes on the poorest Americans by less than one-fifth of one percent. Obama (net worth less than 1 million) only raises taxes on folks who make over $600,000 per year.

Are you reading my blog and making over 600K? If so, that puts you in the top 1% of American taxpayers!!! You top 1% have been getting huge tax breaks for years and Obama's plan simply asks you to pay your fair share.

Are you reading my blog and making less than $110,000 per year? Probably, because that is well over 60% of American taxpayers. You will get more tax relief with Obama's plan.

Don't be distracted by campaign rhetoric, the numbers are clear. Obama has the only rational tax plan to stimulate our economy and balance the budget.

TaxProf Blog: Comparison of the McCain and Obama Tax Plans

The Washington Post ran a story using this data and published this chart:

And CNN breaks it down this way:

At first glance, you see that the Obama plan benefits the most Americans. The number of taxpayers who get a tax break is greatest with the Obama plan.

On the other hand, McCain proposes huge tax breaks for the wealthy. This is just more of the same Republican trickle-down economics which led to skyrocketing national deficits and failed to balance the budget in the Reagan and Bush administrations.

McCain (net worth 21-45 million) gives ultra-rich folks the greatest tax breaks while cutting taxes on the poorest Americans by less than one-fifth of one percent. Obama (net worth less than 1 million) only raises taxes on folks who make over $600,000 per year.

Are you reading my blog and making over 600K? If so, that puts you in the top 1% of American taxpayers!!! You top 1% have been getting huge tax breaks for years and Obama's plan simply asks you to pay your fair share.

Are you reading my blog and making less than $110,000 per year? Probably, because that is well over 60% of American taxpayers. You will get more tax relief with Obama's plan.

Don't be distracted by campaign rhetoric, the numbers are clear. Obama has the only rational tax plan to stimulate our economy and balance the budget.

TaxProf Blog: Comparison of the McCain and Obama Tax Plans

The Obama tax plan would make the tax system significantly more progressive by providing large tax breaks to those at the bottom of the income scale and raising taxes significantly on upper-income earners. The McCain tax plan would make the tax system more regressive, even compared with a system in which the 2001–06 tax cuts are made permanent.

|

The Washington Post ran a story using this data and published this chart:

|

And CNN breaks it down this way:

McCain: The average taxpayer in every income group would see a lower tax bill, but high-income taxpayers would benefit more than everyone else.

Obama: High-income taxpayers would pay more in taxes, while everyone else's tax bill would be reduced. Those who benefit the most - in terms of reducing their taxes as a percentage of after-tax income - are in the lowest income groups.

No comments:

Post a Comment